Wall Streep Prep Discounted Cash Flow Course

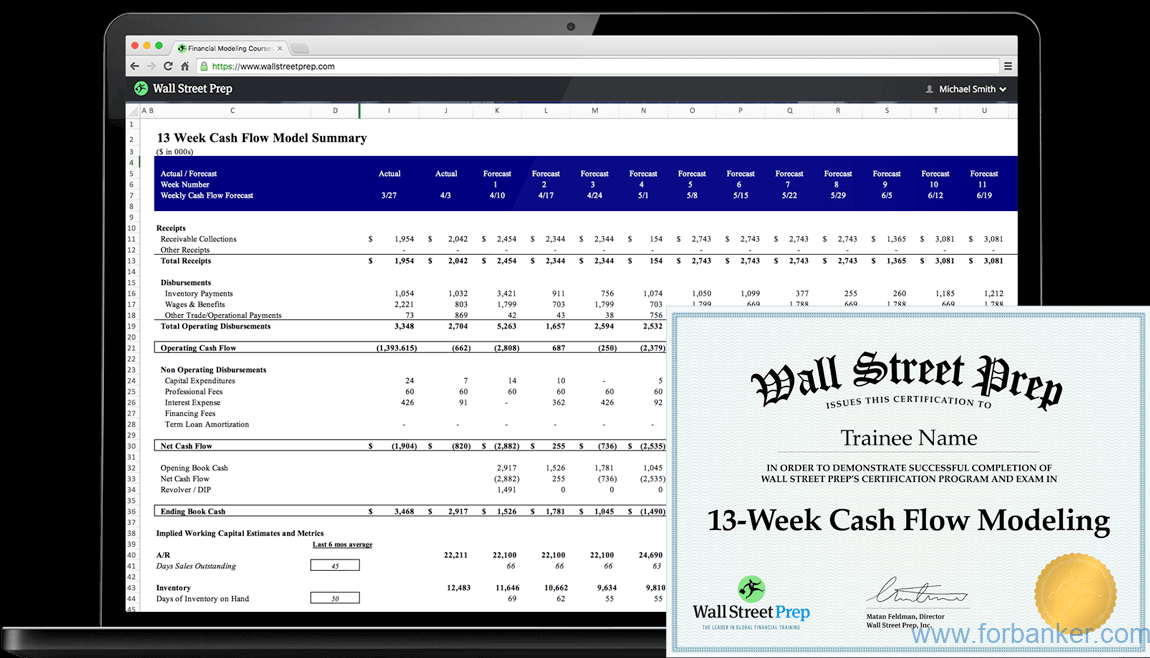

Wall Streep Prep Discounted Cash Flow Course - Wall street prep provides customized training programs for investment banking analysts and associates as well as corporate finance, private equity, financial planning & analysis and. Learn the difference between intrinsic and relative valuation, enterprise vs equity value, and more. As a side benefit, the dcf is the source of a. Our wall streep prep dcf course covers key concepts like cash flow projections, discount rates, terminal value, and more. 40+ years of successcheck training categoriesenroll today!sign up for savings Discounted cash flow analysis (dcf) in every investment banking interview, i guarantee they will ask you a few questions on a dcf. Then, you’ll learn to how put those lessons into. Discounted cash flow (dcf) modeling course this course is designed and delivered by a wall street pro. In this module, we use 9 video lessons to fully break down a dcf analysis. Banks don't look like other companies. Up to 10% cash back this course builds on wall street prep's financial statement modeling course to teach trainees how to build a working discounted cash flow (dcf) model in excel. As a side benefit, the dcf is the source of a. We can express this formulaically as the following (we denote the. It is the most comprehensive course on dcf modeling including theory and. The dcf approach requires that we forecast a company’s future cash flows and discount them to the present to arrive at a present value for the company. Learn the difference between intrinsic and relative valuation, enterprise vs equity value, and more. Ideal for real estate investment and startup valuation. That present value is the amount investors should be willing to pay (the company’s value). Our popular accounting course is designed for those with no accounting background as well as those seeking a. Then, you’ll learn to how put those lessons into. Discounted cash flow analysis (dcf) in every investment banking interview, i guarantee they will ask you a few questions on a dcf. Ideal for real estate investment and startup valuation. As a side benefit, the dcf is the source of a. Discounted cash flow (dcf) analysis is a financial valuation method used to estimate the value of an investment based. Discounted cash flow (dcf) analysis is a financial valuation method used to estimate the value of an investment based on its expected future cash flows. Our wall streep prep dcf course covers key concepts like cash flow projections, discount rates, terminal value, and more. In this module, we use 9 video lessons to fully break down a dcf analysis. That. 40+ years of successcheck training categoriesenroll today!sign up for savings Learn the difference between intrinsic and relative valuation, enterprise vs equity value, and more. The dcf approach requires that we forecast a company’s future cash flows and discount them to the present to arrive at a present value for the company. Ideal for real estate investment and startup valuation. Discounted. National registry of cpe sponsors id number:. Banks don't look like other companies. Our popular accounting course is designed for those with no accounting background as well as those seeking a. The dcf approach requires that we forecast a company’s future cash flows and discount them to the present to arrive at a present value for the company. In this. Discounted cash flow analysis (dcf) in every investment banking interview, i guarantee they will ask you a few questions on a dcf. Transaction comps analysis arrives at a company's value not by building a discounted cash flow or looking at the trading values of peers, but by looking at the purchase prices of recently. The dcf approach requires that we. As a side benefit, the dcf is the source of a. Up to 10% cash back this course builds on wall street prep's financial statement modeling course to teach trainees how to build a working discounted cash flow (dcf) model in excel. In this module, we use 9 video lessons to fully break down a dcf analysis. 40+ years of. Ideal for real estate investment and startup valuation. Discounted cash flow analysis (dcf) in every investment banking interview, i guarantee they will ask you a few questions on a dcf. It is the most comprehensive course on dcf modeling including theory and. Banks don't look like other companies. Up to 10% cash back this course builds on wall street prep's. National registry of cpe sponsors id number:. The dcf approach requires that we forecast a company’s future cash flows and discount them to the present to arrive at a present value for the company. Transaction comps analysis arrives at a company's value not by building a discounted cash flow or looking at the trading values of peers, but by looking. Ideal for real estate investment and startup valuation. Then, you’ll learn to how put those lessons into. Discounted cash flow (dcf) modeling course this course is designed and delivered by a wall street pro. Transaction comps analysis arrives at a company's value not by building a discounted cash flow or looking at the trading values of peers, but by looking. As a side benefit, the dcf is the source of a. Our wall streep prep dcf course covers key concepts like cash flow projections, discount rates, terminal value, and more. Transaction comps analysis arrives at a company's value not by building a discounted cash flow or looking at the trading values of peers, but by looking at the purchase prices. The dcf approach requires that we forecast a company’s future cash flows and discount them to the present to arrive at a present value for the company. We can express this formulaically as the following (we denote the. Banks don't look like other companies. 40+ years of successcheck training categoriesenroll today!sign up for savings As a side benefit, the dcf is the source of a. Discounted cash flow (dcf) analysis is a financial valuation method used to estimate the value of an investment based on its expected future cash flows. Ideal for real estate investment and startup valuation. Up to 10% cash back this course builds on wall street prep's financial statement modeling course to teach trainees how to build a working discounted cash flow (dcf) model in excel. Then, you’ll learn to how put those lessons into. Our popular accounting course is designed for those with no accounting background as well as those seeking a. That present value is the amount investors should be willing to pay (the company’s value). Every single investment bank out there uses a. Learn the difference between intrinsic and relative valuation, enterprise vs equity value, and more. In this module, we use 9 video lessons to fully break down a dcf analysis. National registry of cpe sponsors id number:. Transaction comps analysis arrives at a company's value not by building a discounted cash flow or looking at the trading values of peers, but by looking at the purchase prices of recently.Matan Feldman Wall Street Prep The 13Week Cash Flow Model

Quick Lesson DCF Model Build a Discounted Cash Flow Model, Part 1

Accounting Crash Course(Wall Street Prep) 内容介绍 福贝壳儿 优惠Coupon Discount

Discounted Cash Flow

Wall Street Prep Financial Modeling Quick Lesson DCF1 PDF

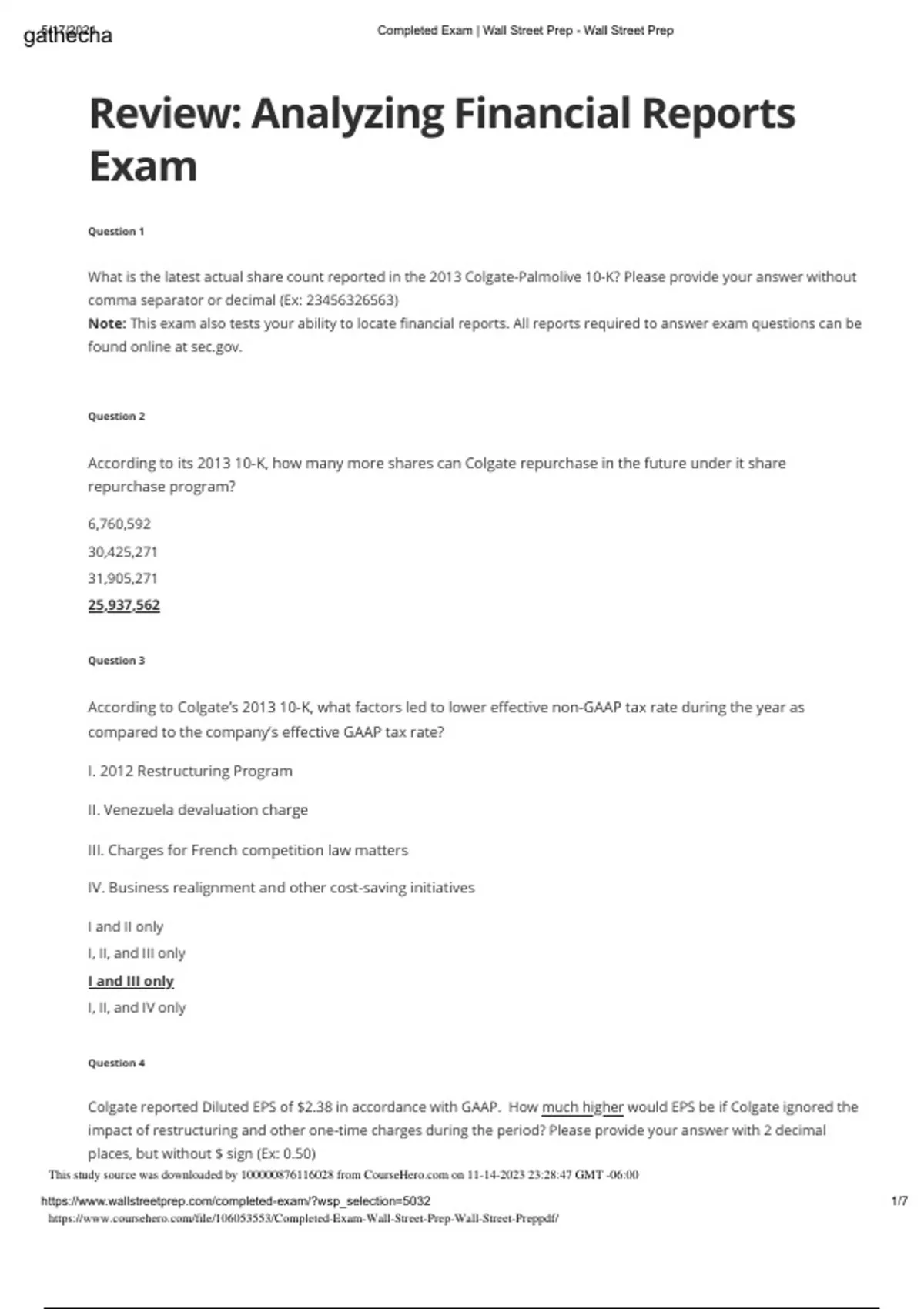

DCF or discounted cash flow model exam answers for Wall street prep

Wall Street Prep Financial Modeling Quick Lesson DCFQL PDF

Wall Street Prep Review Is the 400+ Course Worth It? (2025

Wall Street Prep Financial Planning & Analysis Modeling Certification

The 13Week Cash Flow Model(Wall Street Prep) 内容介绍 福贝壳儿 优惠Coupon

Discounted Cash Flow (Dcf) Modeling Course This Course Is Designed And Delivered By A Wall Street Pro.

Our Wall Streep Prep Dcf Course Covers Key Concepts Like Cash Flow Projections, Discount Rates, Terminal Value, And More.

It Is The Most Comprehensive Course On Dcf Modeling Including Theory And.

Wall Street Prep Provides Customized Training Programs For Investment Banking Analysts And Associates As Well As Corporate Finance, Private Equity, Financial Planning & Analysis And.

Related Post: