Leveraged Buyout Course

Leveraged Buyout Course - Prepare a leveraged buyout (lbo) analysis. The largest leveraged buyouts in history. It starts off by explaining the meaning of an lbo with the. Understand tax implications of various tax structures for both the buyer and. Analyze whether an m&a transaction is accretive or dilutive to the earnings per share of a corporate acquirer. A completed guide to leveraged buyout modeling & technical interview preparation Build a simple lbo model and forecast income statements. Learn to build an lbo model from scratch in cfi's leveraged buyout modeling course. Leveraged buyout (lbo) is the purchase of all or substantially all of a company using large amount of debt. Up to 10% cash back understand the foundational structures and strategies of private equity funds. The largest leveraged buyouts in history. Define leveraged buyouts and their significance in corporate finance. Review an lbo transaction and financing structure; Up to 10% cash back understand the foundational structures and strategies of private equity funds. Dell technologies and silver lake. Leveraged buyout (lbo) modeling is used widely by investment banks and private equity firms and is often part of a finance interview. Explore sources & uses schedules and calculate equity returns. Leveraged buyouts and their history. Build a simple lbo model and forecast income statements. Those with a basic understanding of free cash. In this course, you will learn how to build a real,. Learn about the ins and outs of leveraged private equity buyouts. A completed guide to leveraged buyout modeling & technical interview preparation Learn to build an lbo model from scratch in cfi's leveraged buyout modeling course. Since the 1960s, lbo has been the primary investment strategy of private. Learn to build an lbo model from scratch in cfi's leveraged buyout modeling course. In this course, you will learn how to build a real,. A completed guide to leveraged buyout modeling & technical interview preparation Learn about the ins and outs of leveraged private equity buyouts. Review an lbo transaction and financing structure; A completed guide to leveraged buyout modeling & technical interview preparation Learn leveraged buyouts (lbos) with cfi's newest course. Build a simple lbo model and forecast income statements. Case study of a successful leveraged buyout: Leveraged buyout (lbo) modeling is used widely by investment banks and private equity firms and is often part of a finance interview. Case study of a successful leveraged buyout: Explore sources & uses schedules and calculate equity returns. The largest leveraged buyouts in history. It starts off by explaining the meaning of an lbo with the. Leveraged buyouts and their history. A completed guide to leveraged buyout modeling & technical interview preparation In this course, you will learn how to build a real,. Case study of a successful leveraged buyout: Up to 10% cash back understand the foundational structures and strategies of private equity funds. Learn leveraged buyouts (lbos) with cfi's newest course. Understand market reaction to transactions; Those with a basic understanding of free cash. Learn to build an lbo model from scratch in cfi's leveraged buyout modeling course. The course provides a comprehensive understanding of private equity investment funds and leveraged buyout (lbo) transactions. Since the 1960s, lbo has been the primary investment strategy of private. Dell technologies and silver lake. Case study of a successful leveraged buyout: Analyze whether an m&a transaction is accretive or dilutive to the earnings per share of a corporate acquirer. The largest leveraged buyouts in history. The course provides a comprehensive understanding of private equity investment funds and leveraged buyout (lbo) transactions. Learn leveraged buyouts (lbos) with cfi's newest course. Leveraged buyouts (lbos) allow firms to acquire companies through strategic debt leverage. Up to 10% cash back understand the foundational structures and strategies of private equity funds. Build a simple lbo model and forecast income statements. A completed guide to leveraged buyout modeling & technical interview preparation Explore sources & uses schedules and calculate equity returns. A completed guide to leveraged buyout modeling & technical interview preparation It starts off by explaining the meaning of an lbo with the. Leveraged buyout (lbo) modeling is used widely by investment banks and private equity firms and is often part of a finance interview. Topics covered in this course include: Case study of a successful leveraged buyout: Learn leveraged buyouts (lbos) with cfi's newest course. Analyze whether an m&a transaction is accretive or dilutive to the earnings per share of a corporate acquirer. Leveraged buyouts (lbos) allow firms to acquire companies through strategic debt leverage. Build a simple lbo model and forecast income statements. Prepare a leveraged buyout (lbo) analysis. Dell technologies and silver lake. Leveraged buyout (lbo) is the purchase of all or substantially all of a company using large amount of debt. A completed guide to leveraged buyout modeling & technical interview preparation Define leveraged buyouts and their significance in corporate finance. It starts off by explaining the meaning of an lbo with the. Review an lbo transaction and financing structure; Leveraged buyouts (lbos) allow firms to acquire companies through strategic debt leverage. Case study of a successful leveraged buyout: In this course, you will learn how to build a real,. The operating structure of a leveraged buyout/private equity firm. Understand market reaction to transactions; Leveraged buyouts and their history. Learn about the ins and outs of leveraged private equity buyouts. The course provides a comprehensive understanding of private equity investment funds and leveraged buyout (lbo) transactions. Learn leveraged buyouts (lbos) with cfi's newest course.Leveraged Buyout Modeling Online Deal Making Course

Complete Leveraged Buyout (LBO) Course

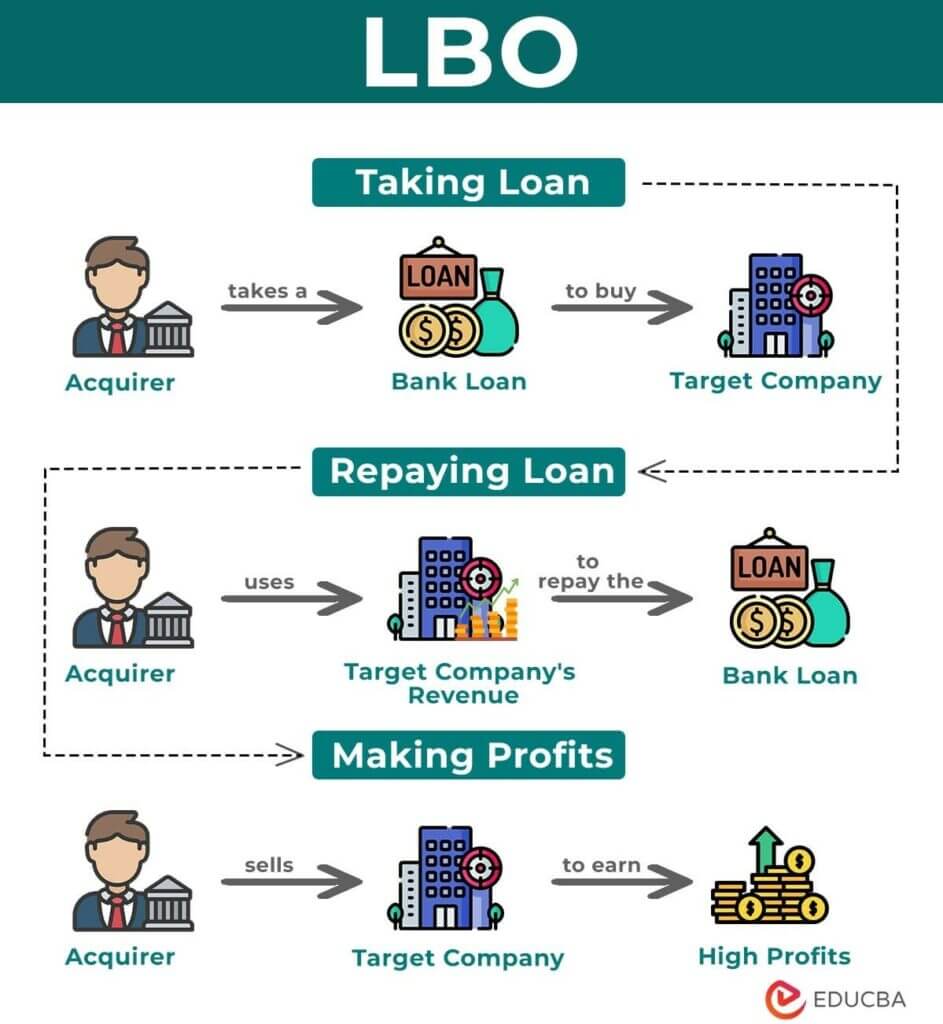

What is a Leveraged Buyout?

What Is Leveraged Buyout Or LBO A Career Guide In 2025

Leveraged Buyout (LBO) Modeling Course at CFI CFI

What is Leveraged Buyout(LBO)? Types, How it Works & Examples

Leveraged Buyout Model

Leveraged Buyout (LBO) Modeling Course at CFI CFI

The Ultimate Guide to Leveraged Buyouts (LBOs) + Examples

Leveraged Buyout (LBO) Modeling Course at CFI CFI

Leveraged Buyout (Lbo) Modeling Is Used Widely By Investment Banks And Private Equity Firms And Is Often Part Of A Finance Interview.

Since The 1960S, Lbo Has Been The Primary Investment Strategy Of Private.

The Largest Leveraged Buyouts In History.

Up To 10% Cash Back Understand The Foundational Structures And Strategies Of Private Equity Funds.

Related Post: