Ea Cpe Courses

Ea Cpe Courses - Discover the ea syllabus with miles! Our new ea exam review leverages 60+ years of trusted study tools to help you pass the ea exam. A comprehensive guide covering all exam sections and key topics to help you excel. Check out the providers offering enrolled agents continuing education free of cost. To become a illinois tax preparer or a illinois professional in preparation of income taxes, you need to attend our required enrolled agent cpe seminars or our enrolled agent cpe classes. The illinois (il) cpe course list from surgent contains thousands of continuing professional education (cpe) options for public accountants and other finance professionals that include a. Yes, most enrolled agent cpe courses are available. Enroll today for tax training you can take online. Enrolled agents must obtain 72 hours of continuing education every three years. Funcpe offers low cost and entertaining online courses for enrolled agents and other tax pros on current tax topics. One year of access to all courses listed below; I enrolled in becker’s ea ce subscription to test it out for myself. Enroll today for tax training you can take online. A comprehensive guide covering all exam sections and key topics to help you excel. They provide courses on various subject areas, including federal tax, business tax, individual tax, ethics and. Enrolled agents must use an. Accepted all 50 statesfree sample courseinstant access Enrolled agents can get free ce credits by attending networking events and participating in online. What are the webce irs enrolled agent cpe course requirements? Funcpe is an irs approved cpe sponsor for ea courses and provides. Get access to all ea ce courses at one single price $199 under a subscription. Our courses are taught by. Enrolled agents must use an. Discover the ea syllabus with miles! The illinois (il) cpe course list from surgent contains thousands of continuing professional education (cpe) options for public accountants and other finance professionals that include a. The illinois (il) cpe course list from surgent contains thousands of continuing professional education (cpe) options for public accountants and other finance professionals that include a. A minimum of 16 hours must be earned per year, two of which must be on ethics. Discover the ea syllabus with miles! They provide courses on various subject areas, including federal tax, business. I enrolled in becker’s ea ce subscription to test it out for myself. Start your enrolled agent journey today! Funcpe is an irs approved cpe sponsor for ea courses and provides. They provide courses on various subject areas, including federal tax, business tax, individual tax, ethics and. Get a detailed insight & comparison of top irs approved ea cpe course. I enrolled in becker’s ea ce subscription to test it out for myself. They provide courses on various subject areas, including federal tax, business tax, individual tax, ethics and. Our new ea exam review leverages 60+ years of trusted study tools to help you pass the ea exam. Enrolled agents must use an. Compare courses, get unbiased reviews, and find. Discover the ea syllabus with miles! Funcpe is an irs approved cpe sponsor for ea courses and provides. I enrolled in becker’s ea ce subscription to test it out for myself. Enrolled agents must use an. Compare courses, get unbiased reviews, and find the best enrolled agent continuing education. Accepted all 50 statesfree sample courseinstant access Accepted all 50 statesfree sample courseinstant access Enrolled agent ce course comparison wordpress data table plugin 1. The illinois (il) cpe course list from surgent contains thousands of continuing professional education (cpe) options for public accountants and other finance professionals that include a. Discover the ea syllabus with miles! Enrolled agents must obtain 72 hours of continuing education every three years. A minimum of 16 hours must be earned per year, two of which must be on ethics. Enrolled agents can get free ce credits by attending networking events and participating in online. Start your enrolled agent journey today! Compare courses, get unbiased reviews, and find the best enrolled. Enrolled agents must obtain 72 hours of continuing education every three years. Yes, most enrolled agent cpe courses are available. What are the webce irs enrolled agent cpe course requirements? They provide courses on various subject areas, including federal tax, business tax, individual tax, ethics and. Accepted all 50 statesfree sample courseinstant access Enroll today for tax training you can take online. Pdf course materials with instant grading and. Enrolled agents must use an. Check out the providers offering enrolled agents continuing education free of cost. Cpe credits for cpascpe credits for easwebinars & seminarsunlimited cpe credits Ea cpe courses to help you fulfill your enrolled agent continuing education requirements. Accepted all 50 statesfree sample courseinstant access Get access to all ea ce courses at one single price $199 under a subscription. Check out the providers offering enrolled agents continuing education free of cost. Enrolled agents must obtain 72 hours of continuing education every three years. Enrolled agent ce course comparison wordpress data table plugin 1. What are the webce irs enrolled agent cpe course requirements? Enrolled agents must obtain 72 hours of continuing education every three years. Our new ea exam review leverages 60+ years of trusted study tools to help you pass the ea exam. Get a detailed insight & comparison of top irs approved ea cpe course providers to choose the best platform for your continuing education & career advancement. Compare courses, get unbiased reviews, and find the best enrolled agent continuing education. One year of access to all courses listed below; Funcpe offers low cost and entertaining online courses for enrolled agents and other tax pros on current tax topics. Yes, most enrolled agent cpe courses are available. Enrolled agents can get free ce credits by attending networking events and participating in online. The illinois (il) cpe course list from surgent contains thousands of continuing professional education (cpe) options for public accountants and other finance professionals that include a. Cpe credits for cpascpe credits for easwebinars & seminarsunlimited cpe credits Discover the ea syllabus with miles! They provide courses on various subject areas, including federal tax, business tax, individual tax, ethics and. Pdf course materials with instant grading and. I enrolled in becker’s ea ce subscription to test it out for myself.7 Best CPE Courses for CPAs of 2025

Becker CPE Course CPE for CPAs and Accountants

Best Enrolled Agent Continuing Education Courses

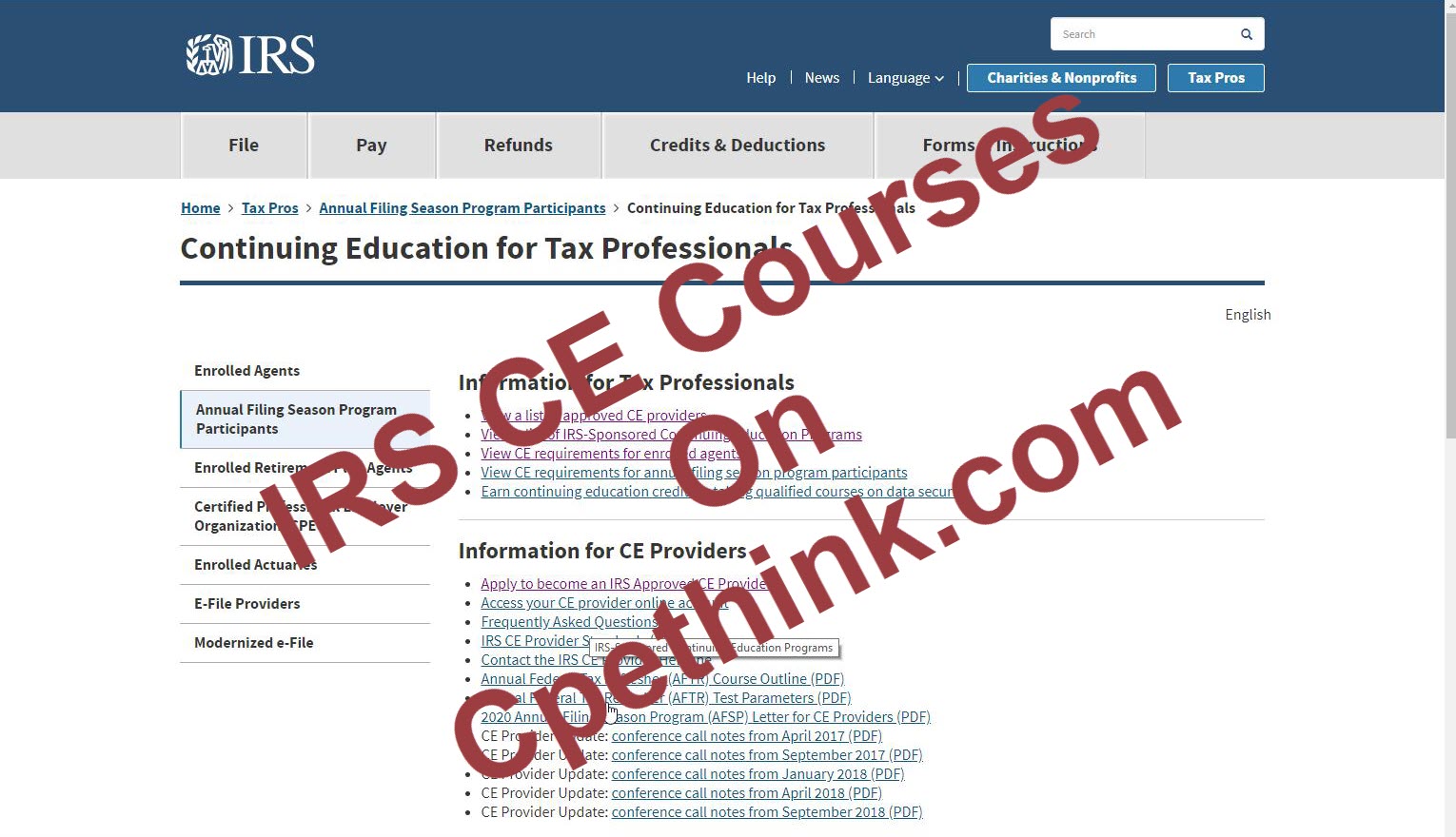

IRS and Enrolled Agent Continuing Education (CPE) Courses

Enrolled Agent Exam Part 1 CRUSH The EA Exam 2022

Enrolled Agent Exam Part 1 CRUSH The EA Exam 2022

Enrolled Agent CPE Continuing Education Requirements

Top IRSApproved EA CPE Providers Courses & Reviews

IRSApproved Enrolled Agent CE Courses Providers

EA CPE Enrolled Agent CPE Courses EA CPE Credits WebCE

Get Access To All Ea Ce Courses At One Single Price $199 Under A Subscription.

To Become A Illinois Tax Preparer Or A Illinois Professional In Preparation Of Income Taxes, You Need To Attend Our Required Enrolled Agent Cpe Seminars Or Our Enrolled Agent Cpe Classes.

Check Out The Providers Offering Enrolled Agents Continuing Education Free Of Cost.

Ea Cpe Courses To Help You Fulfill Your Enrolled Agent Continuing Education Requirements.

Related Post: