Ea Continuing Education Courses

Ea Continuing Education Courses - The irs sets clear mandates for the ea enrollment cycle: 72 hours of enrolled continuing education every three years, including at least 16 hours annually, of which two must. These courses all count toward your continuing education requirements and cover ethics, tax update, and. Discover the ea syllabus with miles! Our courses are taught by. Based on our research, we have selected 8 best platforms offering enrolled agent ce courses. Get access to all ea ce courses at one single price $199 under a subscription. Complete your state, illinois and irs continuing education requirement online! We at our chicago enrolled agent cpe are so confident you will. Advanced practice education associates helps nurse practitioners and nurse practitioner students advance professionally and educationally through review courses, continuing. Based on our research, we have selected 8 best platforms offering enrolled agent ce courses. Choose from three education tracks—tax, ntpi® level 2, or level 3—to sharpen your skills and continue or complete your ntpi journey. We offer high quality & convenient online ce classes that are backed up by our world class customer support to help you meet your requirements. We report irs tax education electronically! We at our chicago enrolled agent cpe are so confident you will. Get access to all ea ce courses at one single price $199 under a subscription. A comprehensive guide covering all exam sections and key topics to help you excel. Find tax classes at tax practitioner institutes in your state and receive continuing education credits at a reasonable cost. 72 hours of enrolled continuing education every three years, including at least 16 hours annually, of which two must. These courses all count toward your continuing education requirements and cover ethics, tax update, and. We at our chicago enrolled agent cpe are so confident you will. Our courses are taught by. We report irs tax education electronically! Webce offers irs enrolled agent cpe courses. Find tax classes at tax practitioner institutes in your state and receive continuing education credits at a reasonable cost. Maintain your credential with becker’s ea continuing education subscription. The ability to filter courses by subject made it. Choose from three education tracks—tax, ntpi® level 2, or level 3—to sharpen your skills and continue or complete your ntpi journey. Find tax classes at tax practitioner institutes in your state and receive continuing education credits at a reasonable cost. 5/5 (10k. The ability to filter courses by subject made it. Start your enrolled agent journey today! Discover the ea syllabus with miles! Level up your career and expand your network! Choose from three education tracks—tax, ntpi® level 2, or level 3—to sharpen your skills and continue or complete your ntpi journey. Choose from three education tracks—tax, ntpi® level 2, or level 3—to sharpen your skills and continue or complete your ntpi journey. We offer high quality & convenient online ce classes that are backed up by our world class customer support to help you meet your requirements. Maintain your credential with becker’s ea continuing education subscription. The ability to filter courses. Choose from three education tracks—tax, ntpi® level 2, or level 3—to sharpen your skills and continue or complete your ntpi journey. Webce offers irs enrolled agent cpe courses. These courses all count toward your continuing education requirements and cover ethics, tax update, and. 72 hours of enrolled continuing education every three years, including at least 16 hours annually, of which. These courses all count toward your continuing education requirements and cover ethics, tax update, and. Level up your career and expand your network! We offer high quality & convenient online ce classes that are backed up by our world class customer support to help you meet your requirements. Start your enrolled agent journey today! Get access to all ea ce. A comprehensive guide covering all exam sections and key topics to help you excel. Discover the ea syllabus with miles! Start your enrolled agent journey today! 72 hours of enrolled continuing education every three years, including at least 16 hours annually, of which two must. Webce offers irs enrolled agent cpe courses. Our courses are taught by. We report irs tax education electronically! Maintain your credential with becker’s ea continuing education subscription. Compare courses, get unbiased reviews, and find the best enrolled agent continuing education. 5/5 (10k reviews) Discover the ea syllabus with miles! 5/5 (10k reviews) The irs sets clear mandates for the ea enrollment cycle: Complete your state, illinois and irs continuing education requirement online! Advanced practice education associates helps nurse practitioners and nurse practitioner students advance professionally and educationally through review courses, continuing. Our courses are taught by. We report irs tax education electronically! Discover the ea syllabus with miles! Maintain your credential with becker’s ea continuing education subscription. Complete your state, illinois and irs continuing education requirement online! These courses all count toward your continuing education requirements and cover ethics, tax update, and. Maintain your credential with becker’s ea continuing education subscription. We at our chicago enrolled agent cpe are so confident you will. Advanced practice education associates helps nurse practitioners and nurse practitioner students advance professionally and educationally through review courses, continuing. Based on our research, we have selected 8 best platforms offering enrolled agent ce courses. The ability to filter courses by subject made it. Compare courses, get unbiased reviews, and find the best enrolled agent continuing education. Our courses are taught by. The irs sets clear mandates for the ea enrollment cycle: Find tax classes at tax practitioner institutes in your state and receive continuing education credits at a reasonable cost. Webce offers irs enrolled agent cpe courses. Complete your state, illinois and irs continuing education requirement online! Level up your career and expand your network! Get access to all ea ce courses at one single price $199 under a subscription. 5/5 (10k reviews) We offer high quality & convenient online ce classes that are backed up by our world class customer support to help you meet your requirements.Enrolled Agent CPE Continuing Education Requirements

EA CPE Enrolled Agent CPE Courses EA CPE Credits WebCE

Best Enrolled Agent Continuing Education Courses

Enrolled Agent Continuing Education Requirements (CPE) CRUSH The EA

IRSApproved Enrolled Agent CE Courses Providers

MasterCPE LLC on LinkedIn EA Archives MasterCPE LLC

IRS Approved Continuing Education Courses Approved Continuing

Enrolled Agent vs CPA Which Is Right for You? CRUSH The EA Exam 2025

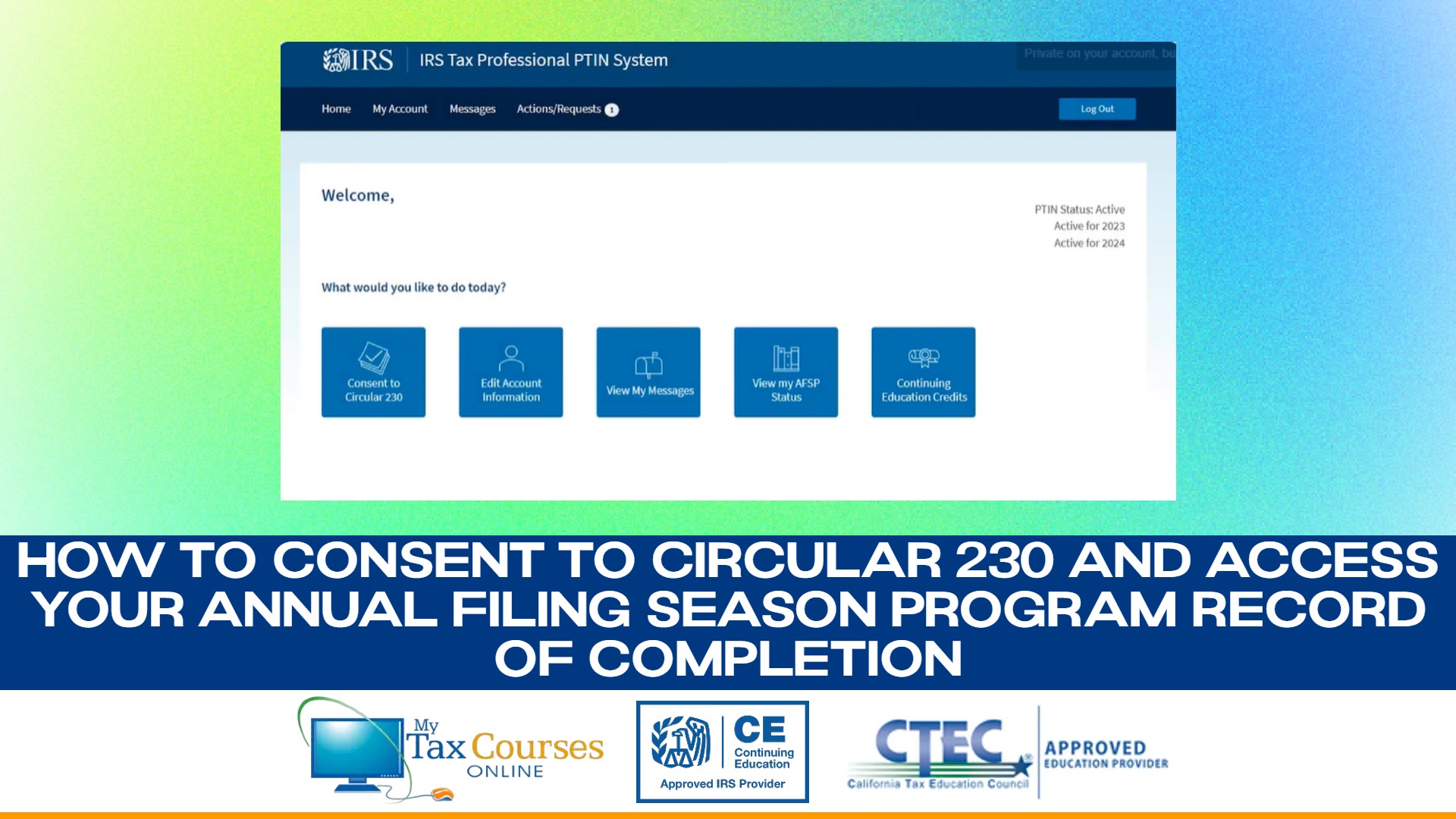

How to Consent to Circular 230 and Access Your Annual Filing Season

Top IRSApproved EA CPE Providers Courses & Reviews

Choose From Three Education Tracks—Tax, Ntpi® Level 2, Or Level 3—To Sharpen Your Skills And Continue Or Complete Your Ntpi Journey.

A Comprehensive Guide Covering All Exam Sections And Key Topics To Help You Excel.

We Will Report Your Ptin To The Irs For.

72 Hours Of Enrolled Continuing Education Every Three Years, Including At Least 16 Hours Annually, Of Which Two Must.

Related Post: