Carbon Accounting Course

Carbon Accounting Course - Develop robust methodologies and tools for measuring carbon emissions, financing and scaling insetting approaches to drive profitability and yield. This certificate is for those interested in a rigorous and professional background that leads to a skill set in ghg accounting, assessing impacts of projects (e.g., additionality and baselines),. Zerogrid’s impact advisory initiative is helping develop a new carbon accounting method that helps connect carbon accounting to carbon impact. This course will provide participants with a foundational understanding of the methodologies and frameworks developed by standards organizations to analyse the credibility of different carbon credit projects, techniques for measuring and analysing carbon data such as geospatial imaging and geospecific remote sensing, tracking methodologies. What are co2 equivalents, what are the three scopes of emissions, and what carbon accounting consists of. Elevate your career as a sustainability, compliance, or environmental professional by mastering the essentials of ghg accounting. Up to 10% cash back carbon accounting is a subset of environmental accounting that focuses specifically on tracking and managing carbon emissions. Build skills to communicate sustainability performance clearly to stakeholders, including investors. Carbon accounting is a complex process that involves gathering large quantities of emissions data from various sources, organizing that data, and using regulatory standards and formulas to. Drive scaled change and transformation by uncovering how to unlock financing. Develop robust methodologies and tools for measuring carbon emissions, financing and scaling insetting approaches to drive profitability and yield. Up to 10% cash back carbon accounting is a subset of environmental accounting that focuses specifically on tracking and managing carbon emissions. Learn from leading experts on all aspects of climate change and greenhouse gas management. Our online courses in carbon and ghg accounting, emissions calculations, emissions reductions and carbon offsetting following the greenhouse gas protocol and iso 14064 standard have been taken and recommended by hundreds of businesses, esg. Drive scaled change and transformation by uncovering how to unlock financing. Browse the full event guide to learn more and join us in driving the revolution of sustainable supply chains. Up to 10% cash back our course begins by demystifying the fundamentals, offering clear explanations of key concepts and definitions surrounding carbon accounting. Ghr’s solution involves expanding traditional emissions accounting to include different timescales. Navigate global carbon markets and. Up to 10% cash back this course is your complete guide to carbon accounting, covering everything from the foundational principles to practical techniques in decarbonization planning. Explore scope 1, 2, and 3. Measuring emissions associated with financial activities is the starting point for financial institutions to manage risk, identify opportunities associated with greenhouse gas emissions. Navigate global carbon markets and. Learn from leading experts on all aspects of climate change and greenhouse gas management. Carbon accounting is a regulatory and strategic necessity, with policies like the. Elevate your career as a sustainability, compliance, or environmental professional by mastering the essentials of ghg accounting. Drive scaled change and transformation by uncovering how to unlock financing. Browse the full event guide to learn more and join us in driving the revolution of sustainable supply chains. Attendees walked away from this revolutionary summit with unique insights to effectively measure,. The carbon management track prepares you for a variety of jobs, in the public, private, and ngo sectors. Up to 10% cash back our course begins by demystifying the fundamentals, offering clear explanations of key concepts and definitions surrounding carbon accounting. Carbon accounting is a complex process that involves gathering large quantities of emissions data from various sources, organizing that. Attendees walked away from this revolutionary summit with unique insights to effectively measure, finance, and scale carbon insetting for a sustainable and profitable future. Crossboundary delivered a masterclass on project finance for project activities as part of gold standard’s masterclass series.this presentation, delivered by crossboundary’s. Join 69m+ learnersimprove your skills210,000+ online courseslearn in 75 languages Browse the full event guide. Attendees walked away from this revolutionary summit with unique insights to effectively measure, finance, and scale carbon insetting for a sustainable and profitable future. Our online courses in carbon and ghg accounting, emissions calculations, emissions reductions and carbon offsetting following the greenhouse gas protocol and iso 14064 standard have been taken and recommended by hundreds of businesses, esg. We believe. Up to 10% cash back you'll learn about the basics of carbon accounting. Our online courses in carbon and ghg accounting, emissions calculations, emissions reductions and carbon offsetting following the greenhouse gas protocol and iso 14064 standard have been taken and recommended by hundreds of businesses, esg. Develop robust methodologies and tools for measuring carbon emissions, financing and scaling insetting. Eeoc compliancemandatory courseswork and school3 credits Carbon accounting is a quickly growing area of demand as governments, companies, and organizations work to reduce their carbon footprint, bring down greenhouse gas emissions, and reach net zero. Up to 10% cash back analyze the intersection of carbon accounting with sustainable finance, including the role of green bonds and carbon pricing. Develop robust. This course will provide participants with a foundational understanding of the methodologies and frameworks developed by standards organizations to analyse the credibility of different carbon credit projects, techniques for measuring and analysing carbon data such as geospatial imaging and geospecific remote sensing, tracking methodologies. We believe in making learning accessible to. Crossboundary delivered a masterclass on project finance for project. We believe in making learning accessible to. Up to 10% cash back analyze the intersection of carbon accounting with sustainable finance, including the role of green bonds and carbon pricing. Crossboundary delivered a masterclass on project finance for project activities as part of gold standard’s masterclass series.this presentation, delivered by crossboundary’s. Carbon accounting is a complex process that involves gathering. Our comprehensive ghg accounting course is designed to meet the needs of two key audiences: Crossboundary delivered a masterclass on project finance for project activities as part of gold standard’s masterclass series.this presentation, delivered by crossboundary’s. Zerogrid’s impact advisory initiative is helping develop a new carbon accounting method that helps connect carbon accounting to carbon impact. Gain insights into the. Zerogrid’s impact advisory initiative is helping develop a new carbon accounting method that helps connect carbon accounting to carbon impact. Develop robust methodologies and tools for measuring carbon emissions, financing and scaling insetting approaches to drive profitability and yield. Learn from leading experts on all aspects of climate change and greenhouse gas management. Our online courses in carbon and ghg accounting, emissions calculations, emissions reductions and carbon offsetting following the greenhouse gas protocol and iso 14064 standard have been taken and recommended by hundreds of businesses, esg. Join 69m+ learnersimprove your skills210,000+ online courseslearn in 75 languages Some job titles you could expect to apply for are: Build skills to communicate sustainability performance clearly to stakeholders, including investors. The carbon management track prepares you for a variety of jobs, in the public, private, and ngo sectors. Browse the full event guide to learn more and join us in driving the revolution of sustainable supply chains. Eeoc compliancemandatory courseswork and school3 credits Explore scope 1, 2, and 3. Up to 10% cash back analyze the intersection of carbon accounting with sustainable finance, including the role of green bonds and carbon pricing. Elevate your career as a sustainability, compliance, or environmental professional by mastering the essentials of ghg accounting. Up to 10% cash back carbon accounting is a subset of environmental accounting that focuses specifically on tracking and managing carbon emissions. This course will provide participants with a foundational understanding of the methodologies and frameworks developed by standards organizations to analyse the credibility of different carbon credit projects, techniques for measuring and analysing carbon data such as geospatial imaging and geospecific remote sensing, tracking methodologies. Measuring emissions associated with financial activities is the starting point for financial institutions to manage risk, identify opportunities associated with greenhouse gas emissions.What is Carbon Accounting? (Scopes and Methods)

What is Carbon Accounting? A Clear Definition with Examples

Carbon Accounting

WP3 Carbon accounting in managed ecosystems Universität Ulm

A Quick Guide to Carbon Management & Accounting Convene ESG

Carbon Accounting What It Is, Methodologies, Examples, Benefits

Carbon Accounting Course & Training Carbon Training Intl

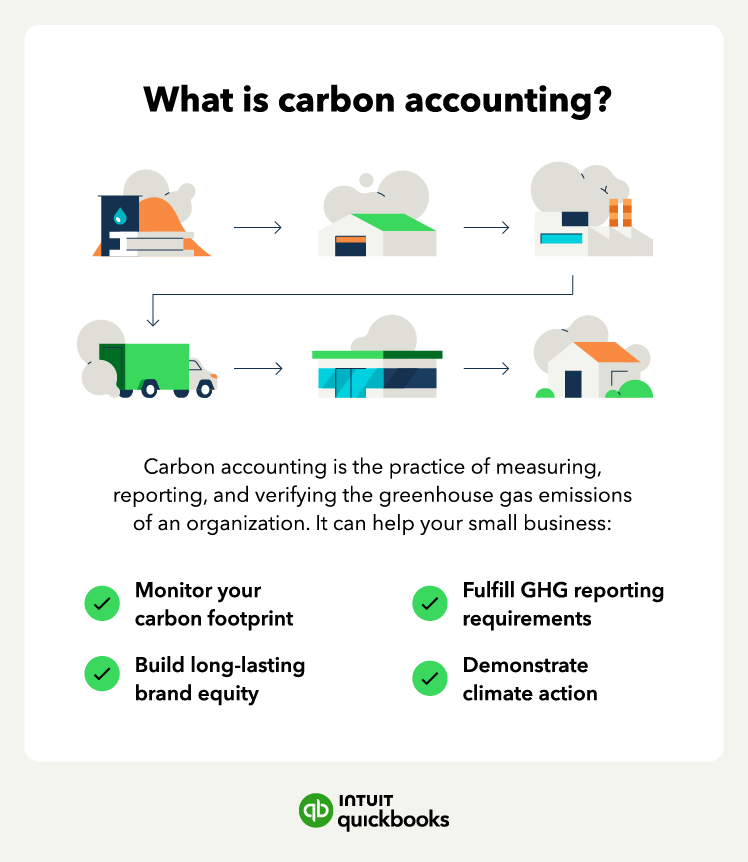

Carbon accounting A beginner's guide for 2023 QuickBooks

Make 2024 your Carbon Accounting year Cynnal Cymru Sustain Wales

Carbon Accounting Software What It Is and How to Evaluate Your Options

Up To 10% Cash Back Our Course Begins By Demystifying The Fundamentals, Offering Clear Explanations Of Key Concepts And Definitions Surrounding Carbon Accounting.

This Certificate Is For Those Interested In A Rigorous And Professional Background That Leads To A Skill Set In Ghg Accounting, Assessing Impacts Of Projects (E.g., Additionality And Baselines),.

Gain Insights Into The Evolving Field Of Carbon Accounting, Enhancing Sustainability Expertise.

Crossboundary Delivered A Masterclass On Project Finance For Project Activities As Part Of Gold Standard’s Masterclass Series.this Presentation, Delivered By Crossboundary’s.

Related Post: