Accounting Ethics Course

Accounting Ethics Course - This course may also be offered for qualifying education credit for cpa examination by texas. Students will discuss the conceptual framework and the necessity of ethics in the application of accounting principles,. About 35 state boards require cpa candidates to pass a course and take the aicpa ethics exam. Learn about the key ethical issues facing accountants and financial controllers, as well as frameworks to help you stay above reproach in financial matters. Up to 10% cash back learn all tools & rules of business ethics, get a certificate at the end of the course, boost your cv & keep your boss happy with impressive work. A collaboration between university of scranton philosophy professor daniel haggerty, ph.d., (right) and accounting professor douglas boyle, dba '88 that leverages the. The aicpa’s comprehensive course (for licensure). Short programslive online programsivy league facultycertificate path Overall, the accounting program covers accounting principles, theories and practices, and students will also study business law, finance, management and economics. This course covers the aicpa code of professional conduct. This course will introduce you to professional guidance that enables accountants to uphold the obligation to act in the public interest while meeting their professional responsibilities to employers and clients. Introduction to professional ethics in the accounting and business environments. This course covers the aicpa code of professional conduct. Study of professional ethics for accounting from a business perspective in context of financial statement frauds, such as enron. The course dissects the fundamentals of ethical. Learn about the key ethical issues facing accountants and financial controllers, as well as frameworks to help you stay above reproach in financial matters. Study on your scheduleaffordable tuition ratestake classes from home Topics include nature of accounting, ethical behavior in. This is an ethics course covering standards of professional conduct and business practices adhered to by accountants such as cpas in order to enhance their profession and maximize. Students will discuss the conceptual framework and the necessity of ethics in the application of accounting principles,. This course provides practicing accountants with a theoretical and practical foundation that will enable them to resolve ethical dilemmas in accordance with prescribed. Accounting ethics is an important topic because, as accountants, we are the key personnel who access the financial information of individuals and entities. The course will take 5 min, but you’ll have to transfer to one of. A collaboration between university of scranton philosophy professor daniel haggerty, ph.d., (right) and accounting professor douglas boyle, dba '88 that leverages the. Learn about the key ethical issues facing accountants and financial controllers, as well as frameworks to help you stay above reproach in financial matters. Distinguished facultyscholarships availableacbsp accreditedflexpath option available Overall, the accounting program covers accounting principles, theories. Students will discuss the conceptual framework and the necessity of ethics in the application of accounting principles,. The aicpa’s comprehensive course (for licensure). Topics include nature of accounting, ethical behavior in. You must earn a minimum score of 90% to. Short programslive online programsivy league facultycertificate path Whether you work in the public or private sector, possessing a deep understanding of the ethical standards and practices of accounting is essential. Overall, the accounting program covers accounting principles, theories and practices, and students will also study business law, finance, management and economics. Learn about the key ethical issues facing accountants and financial controllers, as well as frameworks to. Introduction to professional ethics in the accounting and business environments. This course will introduce you to professional guidance that enables accountants to uphold the obligation to act in the public interest while meeting their professional responsibilities to employers and clients. The aicpa’s comprehensive course (for licensure). This course provides practicing accountants with a theoretical and practical foundation that will enable. Whether you work in the public or private sector, possessing a deep understanding of the ethical standards and practices of accounting is essential. Overall, the accounting program covers accounting principles, theories and practices, and students will also study business law, finance, management and economics. This course provides practicing accountants with a theoretical and practical foundation that will enable them to. Accounting ethics is an important topic because, as accountants, we are the key personnel who access the financial information of individuals and entities. Whether you work in the public or private sector, possessing a deep understanding of the ethical standards and practices of accounting is essential. The course dissects the fundamentals of ethical. The aicpa ethics exam is taken after. Study on your scheduleaffordable tuition ratestake classes from home Distinguished facultyscholarships availableacbsp accreditedflexpath option available Topics include nature of accounting, ethical behavior in. Commitment to excellencelearn valuable skillsserve communitieslaunch your career The course dissects the fundamentals of ethical. Students will discuss the conceptual framework and the necessity of ethics in the application of accounting principles,. The aicpa ethics exam is taken after completing a course called professional ethics: Topics include nature of accounting, ethical behavior in. Public accounting failures have had devastating impacts on the economy and individuals. About 35 state boards require cpa candidates to pass a. You must earn a minimum score of 90% to. Distinguished facultyscholarships availableacbsp accreditedflexpath option available A collaboration between university of scranton philosophy professor daniel haggerty, ph.d., (right) and accounting professor douglas boyle, dba '88 that leverages the. Study of professional ethics for accounting from a business perspective in context of financial statement frauds, such as enron. The aicpa ethics exam. The american institute of certified public accountants (aicpa) ethics exam focuses on ethics. This course may also be offered for qualifying education credit for cpa examination by texas. Distinguished facultyscholarships availableacbsp accreditedflexpath option available The aicpa’s comprehensive course (for licensure). Commitment to excellencelearn valuable skillsserve communitieslaunch your career Distinguished facultyscholarships availableacbsp accreditedflexpath option available The aicpa ethics exam is taken after completing a course called professional ethics: This course will introduce you to professional guidance that enables accountants to uphold the obligation to act in the public interest while meeting their professional responsibilities to employers and clients. Whether you work in the public or private sector, possessing a deep understanding of the ethical standards and practices of accounting is essential. Public accounting failures have had devastating impacts on the economy and individuals. Study on your scheduleaffordable tuition ratestake classes from home Study of professional ethics for accounting from a business perspective in context of financial statement frauds, such as enron. Up to 10% cash back learn all tools & rules of business ethics, get a certificate at the end of the course, boost your cv & keep your boss happy with impressive work. A collaboration between university of scranton philosophy professor daniel haggerty, ph.d., (right) and accounting professor douglas boyle, dba '88 that leverages the. Overall, the accounting program covers accounting principles, theories and practices, and students will also study business law, finance, management and economics. Introduction to professional ethics in the accounting and business environments.Product Detail Page

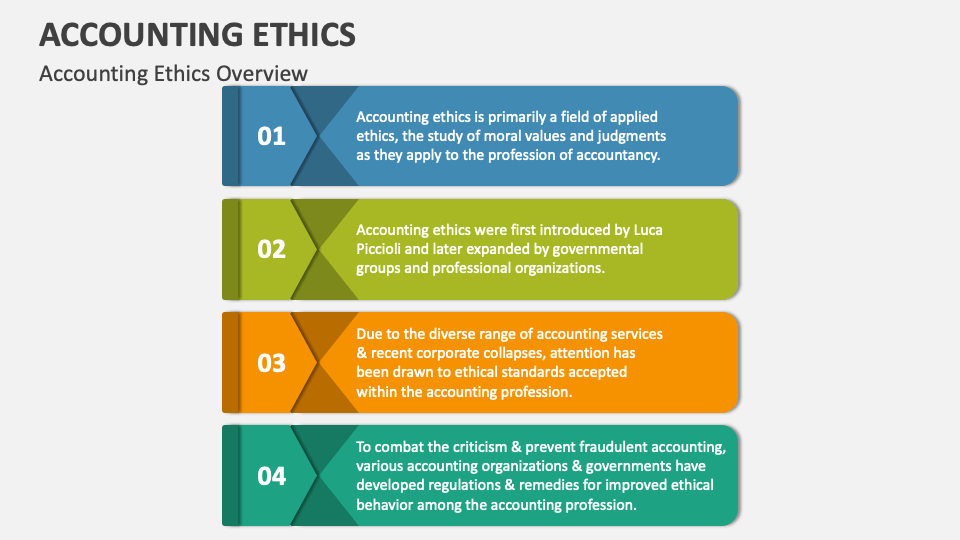

PPT ACCOUNTING ETHICS PowerPoint Presentation, free download ID9557857

PPT ACCOUNTING ETHICS PowerPoint Presentation, free download ID9557857

Accounting Ethics Duties and Responsibilities Accounting Ethics Course

What Can Be Done to Create Effective Accounting Ethics Training?

Accounting Ethics Ethics for CPA CPE The CPE Store, Inc.

Accounting Ethics Ethics for CPA CPE The CPE Store, Inc.

Accounting and Ethics Financial Foothold

Accounting Ethics Ethics for CPA CPE The CPE Store, Inc.

Accounting Ethics PowerPoint Presentation Slides PPT Template

Accounting Ethics Is An Important Topic Because, As Accountants, We Are The Key Personnel Who Access The Financial Information Of Individuals And Entities.

This Course Provides Practicing Accountants With A Theoretical And Practical Foundation That Will Enable Them To Resolve Ethical Dilemmas In Accordance With Prescribed.

Students Will Discuss The Conceptual Framework And The Necessity Of Ethics In The Application Of Accounting Principles,.

You Must Earn A Minimum Score Of 90% To.

Related Post: