Accountant Course Requirements

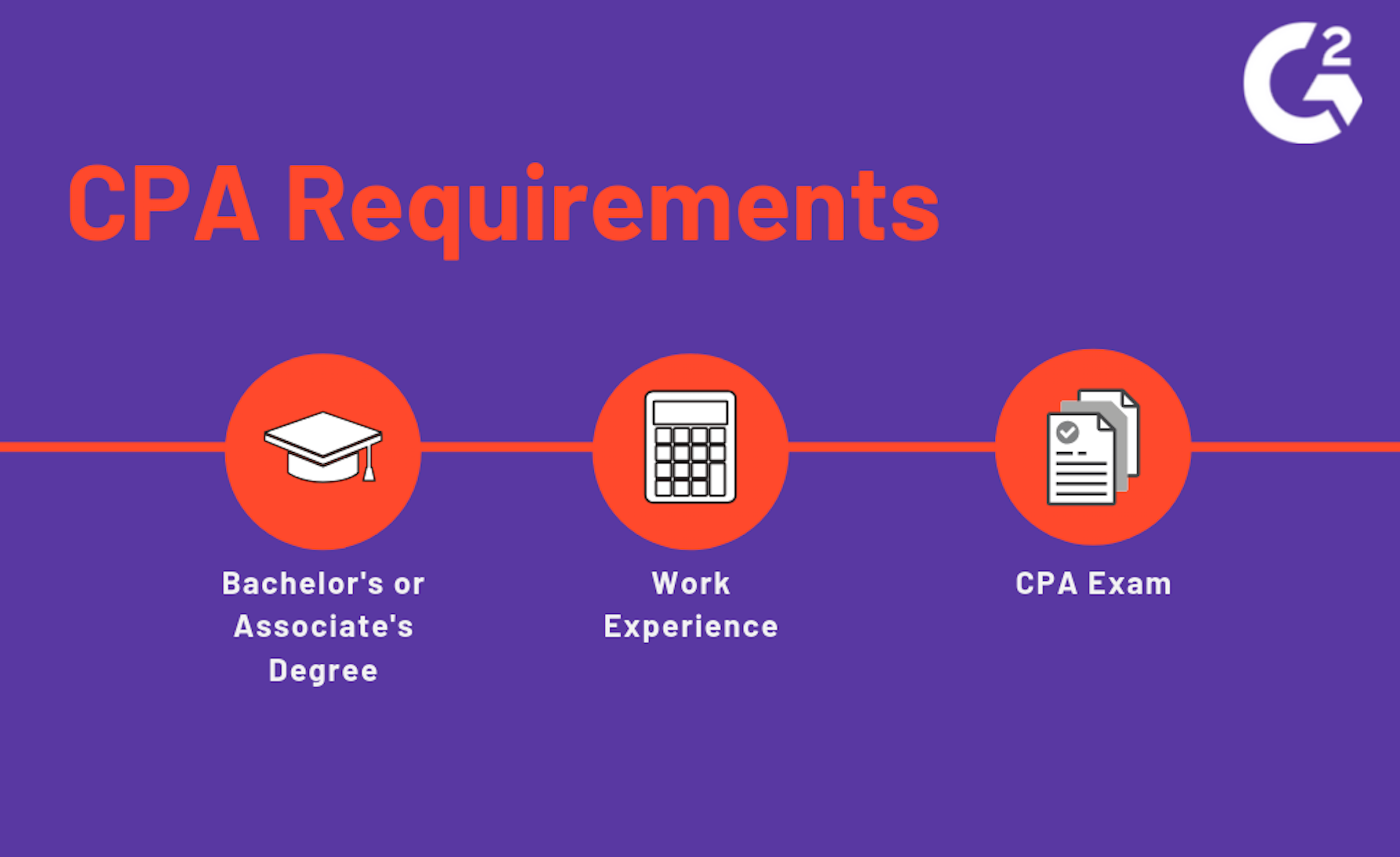

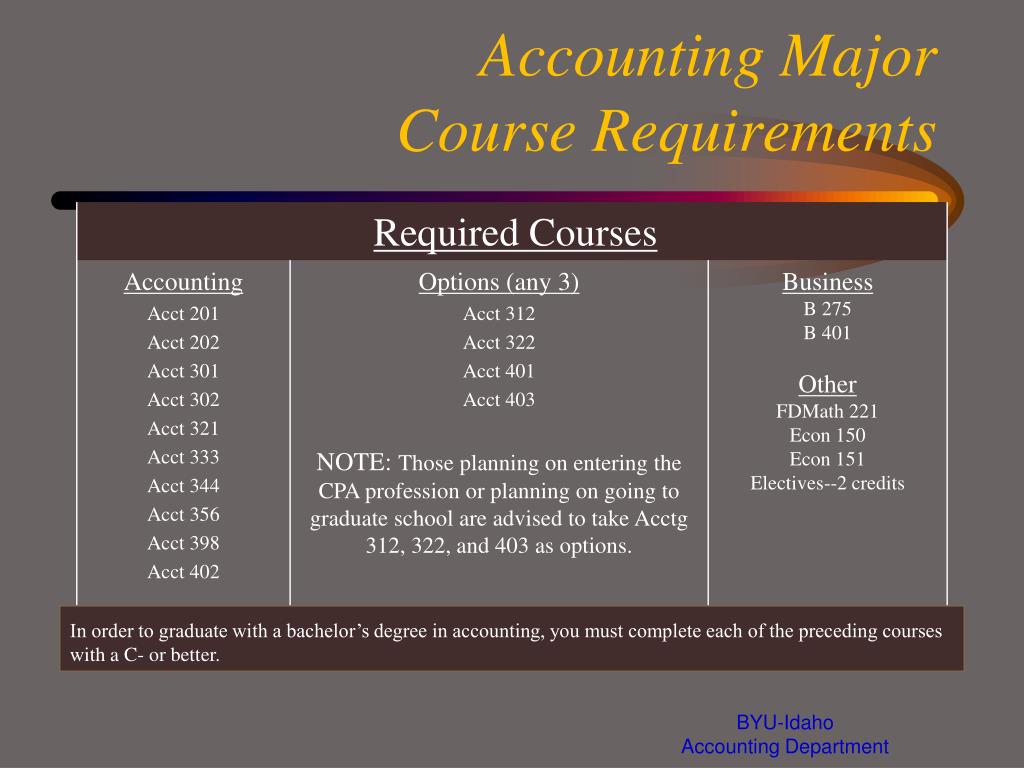

Accountant Course Requirements - Gain insights into degree programs and certifications needed to excel in the field. The 150 credit hour rule. The certified public accountant (cpa) exam is a crucial step for anyone aspiring to enter the accounting profession. It tests the knowledge, skills, and abilities necessary to excel in public. Explore the educational prerequisites for a career in accounting. Of note, bs accounting students must take two writing. Becoming a licensed certified public accountant (cpa) involves acquiring a combination of education, work experience, and passing examination scores. Some general education requirements are fulfilled via coursework that is part of the bs accounting major requirements. Most states require cpa candidates to complete 150 semester hours of college education at an accredited college. Flexible online classesincrease your opportunitycourses designed for you Some general education requirements are fulfilled via coursework that is part of the bs accounting major requirements. Accounting program enrollees can pursue concentrations like auditing, international tax, or forensic accounting to specialize their knowledge and work in specific subfields. Below, we cover some possible steps and considerations in becoming an accountant, from what type of degree to pursue to how to become a certified public accountant (cpa), certified. The 150 credit hour rule. It tests the knowledge, skills, and abilities necessary to excel in public. Find out how to apply, prepare, and pass the cpa exam with becker cpa. The certified public accountant (cpa) exam is a crucial step for anyone aspiring to enter the accounting profession. Each state’s board of accountancy along with the state’s legislature will determine the state’s education requirements 1) for taking the cpa exam, 2) for becoming a. Whether you're starting your journey. Becoming a licensed certified public accountant (cpa) involves acquiring a combination of education, work experience, and passing examination scores. Students planning to major in accounting must be accepted into the college of business.admission requirements to the college of business require completion of 9 lower. Flexible online classesincrease your opportunitycourses designed for you In this article, we will discuss the typical classes required for an accounting degree, including the core courses, electives, and any additional requirements for certification. Learn the. Discover the essential steps to becoming a cpa, including education, experience, exams, and licensing requirements for a successful accounting career. The 150 credit hour rule. Find out how to get a cpa license, the benefits of being a cpa, and. Most states require cpa candidates to complete 150 semester hours of college education at an accredited college. Below, we cover. The certified public accountant (cpa) exam is a crucial step for anyone aspiring to enter the accounting profession. Below, we cover some possible steps and considerations in becoming an accountant, from what type of degree to pursue to how to become a certified public accountant (cpa), certified. Financial aid availabletop 10 online universityevening, weekend & onlineapply now Whether you're starting. Discover the essential steps to becoming a cpa, including education, experience, exams, and licensing requirements for a successful accounting career. Financial aid availabletop 10 online universityevening, weekend & online Pursuing a career as a. Each state’s board of accountancy along with the state’s legislature will determine the state’s education requirements 1) for taking the cpa exam, 2) for becoming a.. The 150 credit hour rule. Becoming a licensed certified public accountant (cpa) involves acquiring a combination of education, work experience, and passing examination scores. Learn the steps to become a cpa in any state, including the minimum requirements for education, experience, and exam. Cpa candidates must hold a bachelor's degree and complete a number of accounting and business courses. Of. Gain insights into degree programs and certifications needed to excel in the field. Below, we cover some possible steps and considerations in becoming an accountant, from what type of degree to pursue to how to become a certified public accountant (cpa), certified. Explore the educational prerequisites for a career in accounting. Discover the essential steps to becoming a cpa, including. Discover the essential steps to becoming a cpa, including education, experience, exams, and licensing requirements for a successful accounting career. Of note, bs accounting students must take two writing. No cost to apply24/7 supportclasses start may 2025transfer credits accepted Find out how to get a cpa license, the benefits of being a cpa, and. Pursuing a career as a. Pursuing a career as a. Financial aid availabletop 10 online universityevening, weekend & onlineapply now Of note, bs accounting students must take two writing. Learn the steps to become a cpa in any state, including the minimum requirements for education, experience, and exam. Each state’s board of accountancy along with the state’s legislature will determine the state’s education requirements 1). Becoming a licensed certified public accountant (cpa) involves acquiring a combination of education, work experience, and passing examination scores. Most states require cpa candidates to complete 150 semester hours of college education at an accredited college. Gain insights into degree programs and certifications needed to excel in the field. Students planning to major in accounting must be accepted into the. Find out how to apply, prepare, and pass the cpa exam with becker cpa. Gain insights into degree programs and certifications needed to excel in the field. No cost to apply24/7 supportclasses start may 2025transfer credits accepted Flexible online classesincrease your opportunitycourses designed for you Some general education requirements are fulfilled via coursework that is part of the bs accounting. Financial aid availabletop 10 online universityevening, weekend & online Accounting program enrollees can pursue concentrations like auditing, international tax, or forensic accounting to specialize their knowledge and work in specific subfields. Most states require cpa candidates to complete 150 semester hours of college education at an accredited college. Each state’s board of accountancy along with the state’s legislature will determine the state’s education requirements 1) for taking the cpa exam, 2) for becoming a. The certified public accountant (cpa) exam is a crucial step for anyone aspiring to enter the accounting profession. Financial aid availabletop 10 online universityevening, weekend & onlineapply now Some general education requirements are fulfilled via coursework that is part of the bs accounting major requirements. No cost to apply24/7 supportclasses start may 2025transfer credits accepted Explore the educational prerequisites for a career in accounting. Discover the essential steps to becoming a cpa, including education, experience, exams, and licensing requirements for a successful accounting career. In this article, we will discuss the typical classes required for an accounting degree, including the core courses, electives, and any additional requirements for certification. Cpa candidates must hold a bachelor's degree and complete a number of accounting and business courses. Of note, bs accounting students must take two writing. Whether you're starting your journey. The 150 credit hour rule. Becoming a licensed certified public accountant (cpa) involves acquiring a combination of education, work experience, and passing examination scores.CPA Course details, application fees and benefits of doing it EduPristine

How To a CPA Get The Pros, Cons and Requirements

Accountant Definition, Knowledge, Types, Responsibilities

Now US CPA Course in India What is a Certified Public Accountant

5 Topics You Should Learn In A Chartered Accountant Course by

Accounting Course in Malaysia Pathway & Requirements

New York CPA Exam Requirements 2025 10 Critical Steps SuperfastCPA

3 CPA Requirements for the Aspiring Public Accountant

CMA Requirements Certified Management Accountant Requirements I Pass

PPT Accounting PowerPoint Presentation, free download ID1033017

Find Out How To Apply, Prepare, And Pass The Cpa Exam With Becker Cpa.

Students Planning To Major In Accounting Must Be Accepted Into The College Of Business.admission Requirements To The College Of Business Require Completion Of 9 Lower.

Below, We Cover Some Possible Steps And Considerations In Becoming An Accountant, From What Type Of Degree To Pursue To How To Become A Certified Public Accountant (Cpa), Certified.

Pursuing A Career As A.

Related Post: